2021 PROXY STATEMENT

AND

NOTICE OF ANNUAL MEETING

OF STOCKHOLDERS

Thursday, June 10, 2021

10:00 a.m., Eastern Time

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

xFiled by a Party other than the Registrant ☐¨

Check the appropriate box:

| ☒ | |

Preliminary Proxy Statement |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

Definitive Proxy Statement |

Definitive Additional Materials |

Soliciting Material under § 240.14a-12 |

EVOLENT HEALTH, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | ||

No fee required. | ||

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

Fee paid previously with preliminary materials. |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

2021 PROXY STATEMENT

AND

NOTICE OF ANNUAL MEETING

OF STOCKHOLDERS

Thursday, June 10, 2021

10:00 a.m., Eastern Time

Dear Fellow Stockholders,

On behalf of Evolent’s Board of Directors, I would like to thank all of our stockholders for your continued support.

As we began to witness the rapidly evolving impacts of the COVID-19 pandemic over a year ago, Evolent adapted quickly to minimize operational disruptions and partnered with customers to drive continued quality-of-care improvements and prioritization of the highest risk patients, all while diligently safeguarding the health and wellbeing of our team. We are tremendously proud of our employees’ dedication and resilience during this highly challenging period.

The past year also marks an important chapter of Evolent’s transformation as we firmly advanced each of the strategic priorities shaping our long-term plan: focused, organic growth, sustainable margin expansion, and balance sheet optimization. We also implemented a program of updates related to our governance practices, Board composition, and leadership team that further position Evolent to create sustainable long-term stockholder value.

Governance Enhancements: The Board continued to evolve our governance practices and directly incorporated feedback from our stockholders into the decision-making process. This year, the Board implemented robust stock ownership guidelines for our executive officers and directors, formally adopted policies to ensure that Evolent considers diverse candidates when conducting both Board and CEO succession planning and adopted a proxy access by-law. At this year’s Annual Meeting, we recommend that stockholders vote in support of amendments to Evolent’s charter to remove our remaining supermajority vote requirements for charter and by-law amendments, and to begin the declassification of the Board.

Continued Board Refreshment: In late 2020 and early 2021, the Board welcomed new independent directors Kim Keck and Craig Barbarosh. With their addition, Evolent has now added six independent directors since late 2015. Ms. Keck brings an exceptional track record and reputation within the health insurance payer community that will be instrumental as Evolent expands our core offerings in that market. Mr. Barbarosh provides extensive healthcare industry knowledge and nearly 30 years of experience as a proven business leader. Our directors’ areas of expertise are individually and collectively aligned with our strategy, which has enabled the Board to enhance—through highly effective oversight—our team’s efforts to drive Evolent’s next phase of profitable growth.

Leadership Updates: A thoughtful, deliberate succession planning process led by our Board culminated with Seth Blackley moving into the role of CEO and Frank Williams stepping into the role of Executive Chairman, effective on October 1, 2020. The Board’s degree of exposure to and ability to observe Seth in recent years through the course of Evolent’s ongoing strategic transformation augmented the Board’s observation and conviction that Seth is the right leader for Evolent’s next phase. As Executive Chairman, Frank continues to be a valuable thought partner for our management team and directors. Finally, in conjunction with Bruce Felt’s retirement from the Board in January 2021, I was appointed by our directors to serve as Evolent’s Lead Independent Director. Our entire Board would like to thank Bruce for his tremendous service; he has been an outstanding director.

Consistent, two-way dialogue with our stockholders remains a key priority for our Board and management team—especially as we continue our strategy of building momentum across our business—and stockholder views remain a valuable input to boardroom deliberations at Evolent. This past fall, in the course of our engagement with stockholders, I had the privilege of meeting with many of our investors to discuss and gain their feedback on our strategy, Board, governance and compensation practices, and our approaches to risk oversight and human capital management. We look forward to building on these conversations in 2021 and beyond.

It is an honor to serve as Evolent’s Lead Independent Director and as a member of the Board on your behalf. My letter would not be complete without acknowledging each of our employees and their hard work throughout the course of the past year. I am extremely proud of what we have accomplished, and look forward to building on our momentum as Evolent continues to transform the way healthcare is delivered and experienced in the United States. We appreciate your investment.

Sincerely,

Cheryl Scott

Lead Independent Director

Evolent Health, Inc.

Dear Fellow Stockholders,

The past year was unprecedented in recent memory. The global COVID-19 pandemic and the movement for racial justice threw into stark relief long-standing issues with our healthcare system—including the need for whole-person health that is affordable and simple. Evolent re-dedicated ourselves to our, core mission, during 2020, delivering our quality and cost improvement solutions to more than nine million individuals across the country. This focus delivered strong results for our members, the communities we serve, our health plan and provider partners, and our stockholders.

We have been focused on our mission of reducing the cost care and improving the quality of care since our inception. Our differentiated products and momentum in this large market led to strong growth performance in 2020. We added eight new partners, including regional and national payers, independent physicians and ACOs. We also significantly expanded with existing partners.

In 2020, we were pleased to contribute to the health of our client’s members. Through our clinical programs, which include complex care, transition care, maternity, and behavioral health, we engaged more than 35,000 high-risk, high-cost patients and evaluated over 60,000 more. We also directly managed over 166,000 active cancer cases across the country.

From a performance perspective, we are pleased that we achieved our key financial objectives for 2020. In 2020, we exceeded the high-end ranges for both our top and bottom-line targets, made strong progress on our cost reduction effort and achieved positive cash flow ahead of schedule. Our consistently strong results across 2020 demonstrate our commitment to execute against our attractive financial model and we carry that momentum into 2021.

In 2020, we grew total revenue by 20.8 percent, from $846.4 million the year prior to $1.0 billion. Adjusted EBITDA1 for the full year was $41.4 million compared to $(11.0) million in 2019. Our strong performance across 2020 was driven by strength in our performance-based arrangements, continued focus on cost control efforts, new partner additions, and cross-sell expansions within our existing partner base.

This growth is propelled by our proven results. For example, as announced by the Centers for Medicare and Medicaid Services in 2020, five Next Generation Accountable Care Organizations (NGACOs) that Evolent supported earned a combined $84 million in savings for Medicare in 20192. This cohort received shared savings payments of more than $66 million and outperformed other ACOs in the program in average savings by approximately 40%. Evolent’s close, collaborative partnership with our partners and approach to managing total cost of care through our proprietary population health technology and clinical capabilities have helped drive these strong results.

Across the organization, we have a strong and diverse leadership team with a wide breath of expertise that helps us to execute on the key objectives of our strategic plan. We are proud that Evolent has established a reputation as a leading destination for the best and brightest in the health care industry. We received more than 130,000 applications for 1,200 filled positions this past year, demonstrating the strong brand we have built for top talent.

As a mission-driven organization, our company culture reflects an atmosphere of respect, honesty and humility. Evolent recently received a perfect 100 score on the Human Rights Campaign Foundation’s Corporate Equality Index for 2020. Across the year, we appointed a Diversity, Equity and Inclusion leader and fostered the development of eight business resource groups, which focus on promoting inclusion, educating on bias and culture and supporting DE&I initiatives. This year we also launched a firmwide inclusion score which debuted at 87%.

Our investment in employee engagement and strong individual and leadership development has allowed us to retain top performers and create a highly motivated workforce. Evolenteers logged more than 42,000 hours of learning and development courses and approximately 15,000 hours of community service in 2020. In response to COVID-19, individuals and teams across the company sewed masks and delivered them to those in need, including over 10,000 masks for children in Chicago communities; volunteered at local food banks; and went above and beyond their normal responsibilities to ensure high-risk members had groceries and medications to stay safe at home. We are proud of our employees living our values and their commitment to drive change during this unprecedented year.

| (1) | Non-GAAP measure. See Appendix C for definition and reconciliation to net loss attributable to common shareholders of Evolent Health, Inc., which was $(334.2) million for the year ended December 31, 2020. |

| (2) | Centers for Medicare and Medicaid Services. Next Generation ACO Model: Performance Year 4 (2019) (XLS). https://innovation.cms.gov/innovation-models/next-generation-aco-model |

In closing, we remain focused on our strategic priorities and connected to our mission of changing the health of the nation by changing the way health care is delivered. I would like to deeply thank all Evolenteers for their continued commitment to our partners and the communities we serve. I would also like to thank our partners, communities, and stockholders in what has been an extraordinary year.

Sincerely,

Seth Blackley

Chief Executive Officer, Co-Founder and Director

Evolent Health, Inc.

EVOLENT HEALTH, INC. 800 N. Glebe Road, Suite 500 Arlington, VA 22203 |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

to be held on June 13, 201810, 2021

|  |  | ||

Date & Time: Thursday, June 10, 2021, 10:00 a.m., Eastern Time | Virtual Information: https://web.lumiagm.com/209916247 password: evolent2021 | Record Date: April 15, 2021 |

Dear Stockholder:

You are invited to attend the 20182021 annual meeting of stockholders (the “Annual Meeting”) of Evolent Health, Inc. (the “Company”), a Delaware corporation, which will be held on Wednesday,Thursday, June 13, 2018,10, 2021, at 10:00 a.m., local time, at 800 N. Glebe Road, Suite 500, Arlington, VA 22203.Eastern Time. The Annual Meeting will be held for the following purposes:

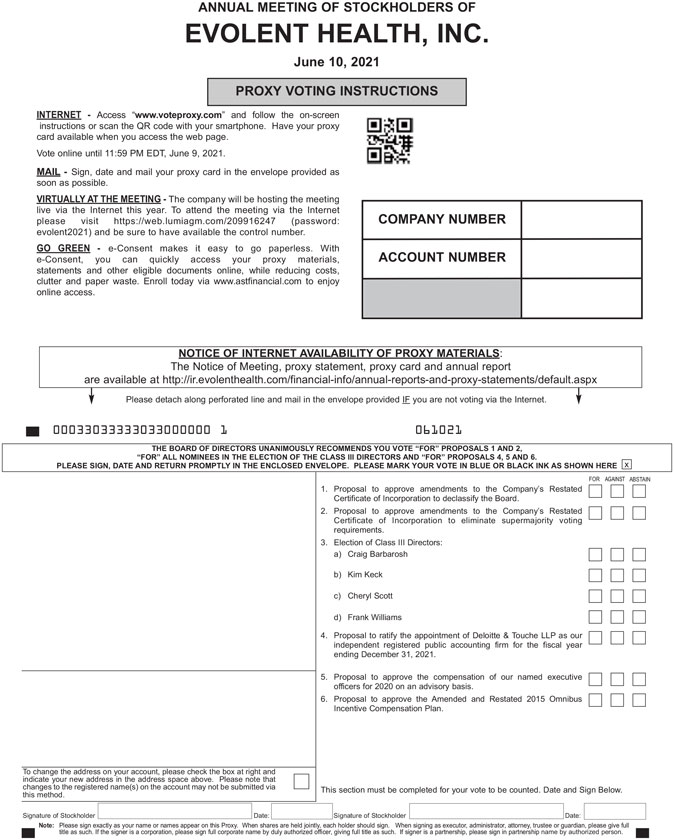

| 1. | To approve proposed amendments to the Company’s Second Amended and Restated Certificate of Incorporation to declassify the Board of Directors; |

| 2. | To approve proposed amendments to the Company’s Second Amended and Restated Certificate of Incorporation to eliminate supermajority voting requirements |

| 3. | To elect |

| 4. | |

To ratify the appointment of |

| 5. | |

To approve the compensation of our named executive officers for |

| 6. | |

To |

In addition, stockholders may be asked to consider and vote upon any other matters that may properly be brought before the Annual Meeting and at any adjournments or postponements thereof.

In light of the coronavirus, or COVID-19, outbreak, for the safety of all of our stakeholders, we have determined that the Annual Meeting will be held in a virtual meeting format only, via the Internet, with no physical in-person meeting. Stockholders will be able to attend, vote and submit questions (for a portion of, the meeting) from any location via the Internet at https://web.lumiagm.com/209916247 . The password for the Annual Meeting is evolent2021. To participate (e.g., submit questions and/or vote), you will need the control number provided on your proxy card, voting instruction form or notice.

Any action may be taken on the foregoing matters at the Annual Meeting on the date specified above, or on any date or dates to which the Annual Meeting may be adjourned, or to which the Annual Meeting may be postponed.

Our Board of Directors has fixed the close of business on April 17, 2018,15, 2021, as the record date for determining the stockholders entitled to notice of, and to vote at, the Annual Meeting and at any adjournments or postponements thereof.

We make proxy materials available to our stockholders on the Internet. You can access proxy materials at

By Order of our Board of Directors,

Jonathan D. Weinberg

General Counsel and Secretary

Arlington, VA

April , 2021

Important Notice Regarding the Availability of Proxy Materials for

This proxy statement and our 20172020 Annual Report to Stockholders are available at

http://ir.evolenthealth.com/Annual-Reports-Proxy-Statements

You may request and receive a paper or email copy of our proxy materials relating to the Annual Meeting

| Page | |||||

| PROXY STATEMENT HIGHLIGHTS | 2 | ||||

AMENDMENTS TO THE COMPANY’S CERTIFICATE OF INCORPORATION TO DECLASSIFY THE BOARD OF DIRECTORS | 6 | ||||

| 8 | |||||

| 10 | |||||

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 17 | ||||

| AUDIT COMMITTEE REPORT | 20 | ||||

| CORPORATE GOVERNANCE AND BOARD STRUCTURE | |||||

| 21 | |||||

| 31 | |||||

| COMPENSATION COMMITTEE REPORT | 46 | ||||

| COMPENSATION OF NAMED EXECUTIVE OFFICERS | 47 | ||||

| Page | |||||

| EQUITY COMPENSATION PLAN INFORMATION | 54 | ||||

| PAY RATIO | 55 | ||||

ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION FOR | |||||

| DIRECTOR COMPENSATION | 57 | ||||

AMENDMENT AND RESTATEMENT OF THE EVOLENT HEALTH, INC. 2015 OMNIBUS INCENTIVE COMPENSATION PLAN | 59 | ||||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 68 | ||||

| CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS | |||||

| 70 | |||||

| QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING | 77 | ||||

| OTHER MATTERS | 82 | ||||

| APPENDIX A | A-1 | ||||

| APPENDIX B | B-1 | ||||

| C-1 | |||||

| APPENDIX D | D-1 | ||||

PRELIMINARY PROXY STATEMENT

EVOLENT HEALTH, INC. 800 N. Glebe Road, Suite 500 Arlington, VA 22203 |

PROXY STATEMENT

FOR OUR 20182021 ANNUAL MEETING

OF STOCKHOLDERS

to be held on June 13, 2018

These proxy materials are being made available in connection with the solicitation of proxies by the Board of Directors (the “Board”) of Evolent Health, Inc., a Delaware corporation, for use at our 20182021 annual meeting of stockholders (the “Annual Meeting”) to be held on Wednesday,Thursday, June 13, 2018,10, 2021, at 10:00 a.m., local time,Eastern Time, in a virtual meeting format only, via the Internet at 800 N. Glebe Road, Suite 500, Arlington, VA 22203,https://web.lumiagm.com/209916247 (password “evolent2021”) or at any postponement or adjournment of the Annual Meeting. There is no physical location for the Annual Meeting. Stockholders will be able to view the Rules of Conduct for the Meeting at http://ir.evolenthealth.com/financial-info/annual-reports-andproxystatements/default.aspx, and submit questions, at https://web.lumiagm.com/209916247 (password “evolent2021”) on the day of the meeting, through the conclusion of the question and answer session that follows.

Distribution of this proxy statement and a proxy card to stockholders is scheduled to begin on or about April , 2021, which is also the date by which these materials will be posted. We encourage stockholder participation in the Annual Meeting, which we have designed to promote stockholder engagement. Stockholders will be permitted to ask questions on the ballot items during the meeting, and on other subjects in a question and answer session that will begin at the conclusion of the meeting. You will also be able to listen to the proceedings and cast your vote online.

As permitted by the rules of the Securities and Exchange Commission (the “SEC”), we are making this proxy statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2020 available to our stockholders electronically via the Internet at http://ir.evolenthealth.com/financial-info/annual-reports-and-proxy-statements/default.aspx. On or about April , 2021, we mailed to our stockholders a Notice of Internet Availability of Proxy Materials (“InternetNotice”), containing instructions on how to access this proxy statement and vote online. If you received an Internet Notice by mail, you will not receive a printed copy of the proxy materials in the mail unless you specifically request them pursuant to the instructions provided in the Internet Notice. The Internet Notice instructs you on how to access and review all of the important information contained in this proxy statement.

References in this proxy statement to “we,” “us,” “our,” “ours,” and the “Company” refer to Evolent Health, Inc., unless the context otherwise requires. Distribution of

Evolent Health, Inc. Proxy Statement 2021 | 1 |

This summary highlights selected information in this proxy statement and— please review the entire document before voting.

Annual Meeting Information

Thursday, June 10, 2021, at 10:00 a.m., Eastern Time.

Via a proxy card to stockholderslive audio-only webcast at https://web.lumiagm.com/209916247(password “evolent2021”). There is scheduled to begin on or about April 27, 2018, which is also the date by which these materials will be posted.

The record date is April 15, 2021.

All of theour Annual Meeting and to votematerials are available in one place at the Annual Meeting. Ifhttp://ir.evolenthealth.com/financial-info/annual-reports-and-proxy-statements/default.aspx. There, you are a holder of recordcan download electronic copies of our Class A common stock orAnnual Report and proxy statement.

| Voting Items | Recommendation | |||||

Item 1 | ||||||

| Approve the proposed board declassification charter amendment | Our Board has determined it is in the best interests of the Company and our stockholders to amend our Restated Certificate of Incorporation to phase out the classified Board |

| FOR | |||

Item 2 | ||||||

| Approve the proposed charter amendment to remove supermajority voting requirements | Our Board has determined it is in the best interests of the Company and our stockholders to amend our Restated Certificate of Incorporation to remove supermajority voting requirements for charter and bylaw amendments |

| FOR | |||

Item 3 | ||||||

| Election of directors | Our four continuing directors up for election bring a valuable mix of skills and qualifications to our Board of Directors |

| FOR | |||

Item 4 | ||||||

Ratify the appointment of the Company’s independent registered public accounting firm for 2021 | Based on its recent evaluation, our Audit Committee believes that the retention of Deloitte & Touche LLP is in the best interests of the Company and its stockholders |

| FOR | |||

Item 5 | ||||||

Say on pay - an advisory vote on the approval of the Company’s executive compensation | Our executive compensation program reflects our commitment to paying for performance and reflects feedback received from stockholder outreach |

| FOR | |||

Item 6 | ||||||

Approve the proposed Amended and Restated 2015 Omnibus Incentive Compensation Plan | Our Board has determined it is in the best interests of the Company and our stockholders to increase the number of shares available for future awards, and implement certain other changes |

| FOR 59 - 67 | |||

| 2 | Evolent Health, Inc. Proxy Statement 2021 |

2020 Performance Highlights

Below are selected highlights of our Class B commonfinancial and operational performance in 2020:

| Revenue | Lives on Platform1 | |

| $1.02 billion | Full Platform: 3.6 million | |

| New Century Health Technology & Services Suite: 6.2 million | ||

| Adjusted EBITDA2 | ||

$41.4 million | ||

Governance Evolution

We are committed to establishing and maintaining strong corporate governance practices that reflect high standards of ethics and integrity and promote long-term stockholder value. In 2020, the Board continued to evolve our governance practices and directly incorporated feedback from our stockholders into the decision-making process. Feedback from our investors was shared with our full Board and directly informed implementation of several key governance enhancements over the past year:

| Robust stock ownership guidelines for our executive officers and directors |

| Formal policies to ensure that Evolent considers diverse candidates when conducting Board and CEO succession planning |

| Seeking stockholder approval at this year’s Annual Meeting to remove our remaining supermajority vote requirements for charter and by-law amendments |

| Seeking stockholder approval at this year’s Annual Meeting to declassify the Board, and |

| Market-standard proxy access by-law |

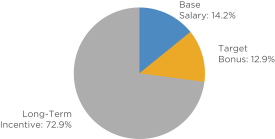

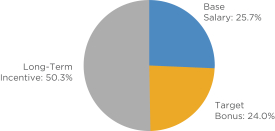

2020 Compensation Program Highlights

Our executive compensation program is designed to facilitate high performance and generate results that will create value for our stockholders. We structure compensation to pay for performance, reward our executives with equity in the Company in order to align their interests with the interests of our stockholders and allow our executives to share in our stockholders’ success, which we believe creates a performance culture, maintains morale and attracts, motivates and retains top executive talent.

| CEO Target Pay | Other NEOs Target Pay | |

|  | |

| (1) | As of December 31, 2020. |

| (2) | Non-GAAP measure, see Appendix C for definition and reconciliation to net loss attributable to common shareholders of Evolent Health, Inc. Net loss attributable to common shareholders of Evolent Health, Inc. was $(334.2) million for the year ended December 31, 2020. |

Evolent Health, Inc. Proxy Statement 2021 | 3 |

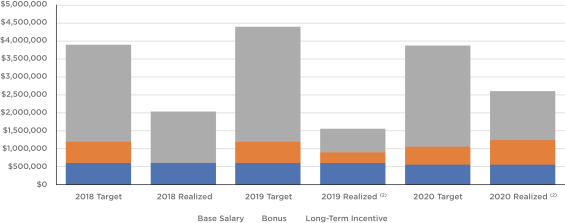

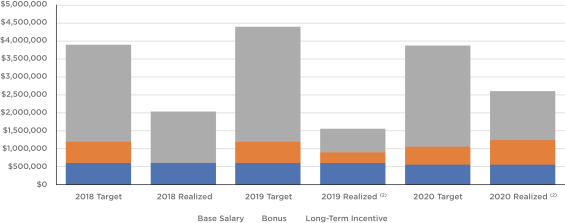

Target and Realized CEO Compensation (1)

| (1) | The realized compensation levels shown include base salary paid in each year, bonuses paid in respect of each year, and payout of all long-term incentives that vested each year (i.e., the value at the time of vesting of RSUs and options in the first quarter of the year after the year in question). |

| (2) | In 2019, the Company experienced a declining stock price, that in combination with the 3-year performance LSU grants, greatly impacted the value of our NEOs’ total actual compensation realized as compared to total target compensation. In the second half of 2020, the Company’s stock price began to recover, but the use of 3-year performance LSU grants in 2019 and 3-year and 3.5-year performance LSU grants in 2020 continued to greatly impact the value of our NEOs’ total actual compensation realized as compared to total target compensation. 2020 compensation reflects Mr. Blackley’s compensation, and his first year as CEO. |

The primary elements of our fiscal year 2020 executive compensation program are base salary, annual bonuses, equity incentive awards and certain employee benefits. Our Compensation Committee reviews and approves our executive compensation program, and maintains the discretion to adjust awards and amounts paid to our executive officers as it deems appropriate. We believe our named executive officers are compensated in a manner consistent with our strategy, compensation best practices and alignment with stockholders’ interests.

| 4 | Evolent Health, Inc. Proxy Statement 2021 |

Below is a more detailed summary of the record date, you may vote the sharesbest practices that you held on the record date even if you sell such shares after the record date. Each outstanding share as of the record date entitles its holder to cast one vote for each matter to be voted upon and,we have implemented with respect to the electioncompensation of our NEOs because we believe they support our compensation philosophy and are in the best interests of our Company and our stockholders.

| What We Do |

|

| What We Don’t Do |

|

Evolent Health, Inc. Proxy Statement 2021 | 5 |

AMENDMENTS TO THE COMPANY’S CERTIFICATE OF INCORPORATION TO DECLASSIFY THE BOARD OF DIRECTORS

Our Second Amended and Restated Certificate of Incorporation (the “Restated Certificate of Incorporation”) currently provides for a classified Board divided into three classes of directors, one votewith each class elected for each directorstaggered three-year terms. We instituted this structure at the time of our initial public offering to be elected. Stockholders do not haveprovide us with stability and continuity and encourage a long-term perspective from our Board.

The Board is proposing these amendments after a review of our corporate governance principles. In evaluating the right to cumulate voting for the election of directors.

The proposed Declassification Amendment will amend Article Five of our Restated Certificate of Incorporation to provide that our classified Board structure will be phased out beginning at the Annual Meeting such that at and after the 2023 annual meeting of stockholders, all directors will be up for election and will serve for a term of one year and until theirsuch directors’ successors are duly elected and qualified;

The Declassification Amendment also provides that directors elected to fill any vacancy on the Board, or to fill newly created director positions resulting from an increase in the number of directors, before the 2023 annual meeting of stockholders would serve the remainder of the term for the fiscal year ending December 31, 2018;

Under Delaware law, directors of companies that have a classified Board may be removed only for cause, unless the certificate of incorporation provides otherwise, and directors of companies that do not have a classified board may be removed with or without cause. Article Five of our Restated Certificate of Incorporation provides that a director may be removed from office only with cause and upon the approval of an amendment to the Evolent Health, Inc. 2015 Omnibus Incentive Compensation Plan;

This description of the proposed Declassification Amendment is only a summary of the proposed amendments to our Restated Certificate of Incorporation and is qualified in its entirety by reference to,

| 6 | Evolent Health, Inc. Proxy Statement 2021 |

Proposal 1: Amendments to the Company’s Certificate of Incorporation to Declassify the Board of Directors

and should be read in conjunction with, the full text of Article Five of our Restated Certificate of Incorporation, as proposed to be amended, a copy of which is attached to this Proxy Statement as Appendix A.

The affirmative vote of the holders of at least 75% of the Annual Meeting is necessary to constitute a quorum forvoting power of the transaction of any business at the Annual Meeting. As of April 17, 2018, the record date, there were 77,064,291outstanding shares of our Class A common stock outstanding and entitled to vote and 880,646 shareswith respect to this proposal is required to approve this proposal.

If our stockholders approve the proposed Declassification Amendment, we intend to file a Certificate of our Class B common stock outstanding and entitled to vote.

If our stockholders do not approve this proposed amendment to the Restated Certificate of Incorporation, our Board will remain classified, and the Class III directors will stand for election under Proposal 3 for a three-year term.

The Declassification Amendment does not change the present number of directors oneor the Board’s authority to change that number and to fill any vacancies or newly created directorships.

The Board also intends to approve conforming amendments to our Bylaws, contingent upon stockholder approval of the Declassification Amendment.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE APPROVAL OF THE AMENDMENTS TO THE COMPANY’S CERTIFICATE OF INCORPORATION TO DECLASSIFY THE BOARD OF DIRECTORS.

Evolent Health, Inc. Proxy Statement 2021 | 7 |

AMENDMENTS TO THE COMPANY’S CERTIFICATE OF INCORPORATION TO ELIMINATE SUPERMAJORITY VOTING REQUIREMENTS

Our Restated Certificate of Incorporation currently provides that certain amendments to the Restated Certificate of Incorporation or the Company’s Third Amended and Restated By-Laws (the “Restated By-Laws”) require the affirmative vote for each director to be elected. Abstentions and “broker non-votes” (i.e.,of the holders of at least 75% of the voting power of the outstanding shares represented atof the meeting held by brokers, as to which instructions have not been received from the beneficial owners or personsCompany’s capital stock entitled to vote such shares and with respect thereto. We refer to which, on a particular matter,these provisions listed below as the broker does not have discretionary voting power to vote such shares) will be counted for purposes of determining whether a quorum is present for“Supermajority Voting Requirement.” We instituted the transaction of businessSupermajority Voting Requirement at the Annual Meeting.

The Board is requiredproposing these amendments after a review of our corporate governance principles. In evaluating the continuation of the Supermajority Voting Requirement, we considered arguments in favor of and against the provisions. We recognize that supermajority voting requirements are intended to approve each proposal?

After carefully weighing these considerations, and after seeking and carefully weighing input from our stockholders, the Board approved and determined it is in the best interests of the Company and our stockholders to amend our Restated Certificate of Incorporation to remove the Supermajority Voting Requirement contained therein. If approved, future stockholder-approved amendments to the By-Law and Certificate of Incorporation provisions listed above will not be subject to the Supermajority Voting Requirement and will instead require the affirmative vote of a majority of votes castthe Company’s outstanding shares of stock entitled to vote generally in the election of directors (the “Supermajority Amendment”). The Board recommends that stockholders approve the Supermajority Amendment, which is attached to this Proxy Statement as Appendix B.

Specifically, Article VII of the Restated Certificate of Incorporation provides that any adoption, alteration, amendment, or repeal of the Restated By-Laws must be approved pursuant to the Supermajority Voting Requirement. In addition, Article VIII of the Restated Certificate of Incorporation provides that the provisions of Article V (board size, classification and tenure, board vacancies and director removal), Sections 6.01 (stockholder action by written consent) and 6.02 (special meetings of stockholders) of Article VI, Articles VII (amendments to by-laws), Article VIII (amendments to certificate of incorporation), Article IX (indemnification and limitation of liability of directors), Article X (opt-out of Section 203 of the DGCL and limitation on certain business combinations) and Article XI (jurisdiction and forum) may not be repealed or amended, and no other provision may be adopted, amended or repealed which would have the effect of modifying or circumventing any such provisions, without approval pursuant to the Supermajority Voting Requirement. This Proposal 2 proposes to amend these provisions by replacing the reference to “75%” with “a majority, as well as remove certain obsolete language.

This description of the Supermajority Amendment is only a summary of the proposed amendments to our Restated Certificate of Incorporation and is qualified in its entirety by reference to, and should be read in conjunction with, the full text of Articles VII and VIII of our Restated Certificate of Incorporation, as proposed to be amended, a copy of which is attached to this Proxy Statement as Appendix B.

| 8 | Evolent Health, Inc. Proxy Statement 2021 |

Proposal 2: Amendments to the Company’s Certificate of Incorporation to Eliminate Supermajority Voting Requirements

The affirmative vote of the holders of at least 75% of the voting power of the outstanding shares of our Class A common stock and Class B common stock, voting together as one class, whether present in person or by proxy at our Annual Meeting and entitled to vote for the proposal to be approved.

If our stockholders approve the proposed Supermajority Amendment, we intend to file a Certificate of Amendment setting forth the Supermajority Amendment and, if approved by stockholders, the Declassification Amendment described in Proposal 1 with the Secretary of State of the State of Delaware during the Annual Meeting, if your sharesafter the certification of Class A common stock or Class B common stock are deemedthe votes on Proposals 1 and 2, and prior to be present at the Annual Meeting, either because you attend the Annual Meeting or because you have properly completed and returned a proxy, but you do not vote on any proposal or other matter which is required to be voted on by our stockholders at the Annual Meeting. Abstentions and broker non-votes are not considered votes cast and will have no effect on the vote for any proposal.

If our independent registered public accounting firm for the fiscal year ending December 31, 2018;

You may access our proxy materials over the Internet at http://ir.evolenthealth.com/Annual-Reports-Proxy-Statements. If you did not receive a paper copy of the proxy materials, the materials sent to you by your broker, nominee or other organization include instructions on how to request a printed set of the proxy materials by mail or an electronic set of materials by email. In addition, stockholders may request to receive future proxy materials in printed form, by mail or electronically by email on an ongoing basis. Choosing to receive future proxy materials by email will save the Company the cost of printing and mailing documents to you and will reduce the environmental impact of the Annual Meeting. If you choose to receive future proxy materials by email, you will receive an email next year with instructions containing a link to those materials and a link to the proxy voting site. Your election to receive future proxy materials by email will remain in effect until you terminate it.

Evolent Health, Inc. Proxy Statement 2021 | 9 |

Our Board currently consists of eleventen members and is divided into three staggered classes of directors, as nearly equal in number as possible. The current termmembers of office of our Class III Directors expiresare due to stand for election at the Annual Meeting, whileMeeting.

Proposal 1 requests that our stockholders approve an amendment to our Restated Certificate of Incorporation to phase out the term for our Class I Directors expiresclassified Board so that the Board is fully declassified at the 20192023 annual meeting of stockholders. If Proposal 1 is approved, we intend to file an amendment to our Restated Certificate of Incorporation to effect the Declassification Amendment with the Secretary of State of the State of Delaware during the Annual Meeting, after the certification of the vote on Proposals 1 and 2 and prior to the closing of the polls on this Proposal 3. The Declassification Amendment will become effective upon such filing and effectiveness. In that case, each Class III director nominee will stand for election under this Proposal 3 for a one-yearterm for our Class II Directors expiresexpiring at the 20202022 annual meeting. meeting of stockholders. If Proposal 1 is not approved, our Board will remain classified, and each Class III director nominee will stand for election under this Proposal 3 for a three-year term expiring at the 2024 annual meeting of stockholders.

Upon unanimous recommendation by the Nominating and Governance Committee of the Board, the Board proposes that the following nominees, Bruce Felt, Kenneth Samet,Craig Barbarosh, Kim Keck, Cheryl Scott and Frank Williams, each a current Class III Director, be elected for new terms of three yearsas described above and until their successors are duly elected and qualified as Class III Directors.qualified. Each of the nominees has consented to serve if elected. All of our director nominees are current members of our Board. If any of them becomes unavailable to serve as a director, the Board may designate a substitute nominee. In that case, the persons named as proxy holders will vote for the substitute nominee designated by the Board. There is no limit on the number of terms a director may serve on our Board.

Pursuant to the stockholders agreement we entered with TPG Global, LLC and certain of its affiliates (“TPG”), University of Pittsburgh Medical Center (“UPMC”) and The Advisory Board Company (“The Advisory Board”)stockholders at the time of our initial public offering, for so long as eachUniversity of TPG, UPMC and The Advisory BoardPittsburgh Medical Center (“UPMC”) owns or owned at least 40% of the shares of common stock held by it followingupon the completion of our initial public offering, such stockholderUPMC will be or was entitled to nominate two directors to serve on our Board. When such stockholderUPMC owns less than 40% but at least 5% of the shares of common stock held by it followingupon the completion of our initial public offering, such stockholderUPMC will be entitled to nominate one director to serve on our Board. As of April 17, 2018, TPG and The Advisory Board each owned lessUPMC owns more than 40% but at least 5% of their respectivethe shares of our common stock it held followingupon the completion of our initial public offering and UPMC owned more than 40%. Upon ceasing to hold at least 40%as of the sharesdate of common stock held by it following the completion of our IPO, in accordance with the terms of the stockholders agreement, one of TPG's designees offered to tender his resignation, but the Board did not accept this offer. Michael Kirshbaum, who had been appointed to the Board by The Advisory Board, resigned from the Board on November 17, 2017. Subsequent to Mr. Kirshbaum's resignation, The Advisory Board held less than 40% of the shares of common stock held by it following the completion of our IPO.proxy statement. Pursuant to these provisions, TPG has designated Matthew Hobart and Norman Payson, MD, UPMC has designated Diane Holder and David Farner,Farner. In accordance with a Cooperation Agreement entered into on December 21, 2020 (the “Cooperation Agreement”) between us and The AdvisoryEngaged Capital, LLC and certain of its affiliates (the “Engaged Group”), the Board has designated Michael D’Amato. TPG, UPMCappointed Craig Barbarosh as a Class III Director and The Advisoryagreed to nominate Mr. Barbarosh for election to the Board have agreed inat the stockholders agreement to vote for each other’s Board nominees, none of whom are up for reelection under this Proposal 1, as well as for Frank Williams, our Chief Executive Officer, who is up for reelection under this Proposal 1.

Information Regarding Director Nominees and Directors

Set forth below is biographical information about each of the directors and director nominees. In addition, we have described the experience, qualifications, attributes and skills of each director the Board considered in determining that such director should serve on our Board.

| 10 | Evolent Health, Inc. Proxy Statement 2021 |

Proposal 3: Election

Auction.com). Director/Nominee Skills Matrix

| Barbarosh* | Blackley | D’Amato | Duffy | Farner | Grua | Holder | Keck* | Scott* | Williams* | |||||||||||||

| Risk Oversight/Management Experience allows the Board to oversee and understand the most significant risks facing the Company | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | |||||||||||

| Healthcare Industry Experience is critical for understanding and overseeing the Company’s strategy and challenges | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | |||||||||||

| Financial Expertise/Literacy adds value in oversight of our financial reporting and internal controls | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ||||||||||||

| Executive Experience supports our management team through relevant advice and leadership | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | |||||||||||||

| Technology Expertise brings value in overseeing innovative technology developments of our platform, as well as cybersecurity and data privacy | ✔ | ✔ | ✔ | ✔ | ✔ | ||||||||||||||||

| ESG Expertise allows the Board to assess and consider adopting environmental, social and governance practices and interact effectively with stakeholders | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | |||||||||||||||

| Government/Regulatory/Public Policy Expertise adds value to the oversight of regulated aspects of our business and general industry developments | ✔ | ✔ | ✔ | ✔ |

| * | Standing for election at the Annual Meeting |

Evolent Health, Inc. Proxy Statement 2021 | 11 |

From October 2006 to July 2012, Mr. Felt served as the Chief Financial Officer of SuccessFactors, Inc. From February 2005 through August 2006, Mr. Felt served as chief financial officer of LANDesk Software, Inc. Subsequent to LANDesk’s acquisition by Avocent Corp. in August 2006, Mr. Felt was retained by Avocent through February 2007 on a transitional basis to manage certain matters. From April 1999 to February 2005, Mr. Felt served as Chief Financial Officer of Integral Development Corporation. Mr. Felt currently sits on the board of directors of Hightail Inc., Alfresco Software, Inc. and Personal Capital Corporation and has been a member of various non-profit boards. Mr. Felt was a member of the board of directors of Yodlee, Inc., a public company, from March 2014 until November 2015. Mr. Felt holds a bachelor of science in accounting from the University of South Carolina and a master’s degree in business administration from Stanford University Graduate School of Business. We believe that Mr. Felt is qualified to serve on our Board because of his financial and accounting background, as well as his experience serving as a senior executive for publicly traded technology companies.PROPOSAL 3: ELECTION OF DIRECTORS

Kenneth Samet has served on our Board since September 2015. Since January 2008, Mr. Samet has served as Chief Executive Officer of MedStar Health, Inc. He previously served as that organization’s President from 2003 and as Chief Operating Officer from 1998. From 1990 to 2000, Mr. Samet served as President of MedStar Washington Hospital Center. From the mid-1980s to 1990, he held a variety of leadership positions with the Medlantic Healthcare Group. Mr. Samet served as a director of Catalyst Health Solutions, Inc., a public company, from April 2006 to July 2012, and has served as a Director of Cogentix Medical, Inc., a public company, since July 2016. Mr. Samet received a bachelor’s degree in business administration from the Old Dominion University and a master’s degree in health services administration from the University of Michigan. We believe that Mr. Samet is qualified to serve on our Board because of his extensive career in healthcare, leadership and corporate governance.

Directors Standing for Election | Election of Class III Directors |

Independent Director Partner, Katten Muchin Rosenman LLP Director Since December 2020 Other Public Boards Landec Corporation Nextgen Healthcare, Inc. Sabra Health Care REIT, Inc. Evolent Board Committees • Compensation, Strategy | Craig Barbarosh, Age 53 | |||

Craig Barbarosh has been a partner at the law firm of Katten Muchin Rosenman since 2012. From 1999 until joining Katten, Mr. Barbarosh was a partner at another international law firm. Mr. Barbarosh currently serves as the Chairman of the Board of Directors for the Landec Corporation and has been an independent director there since October 2019. Mr. Barbarosh is also currently the Vice Chairman of the Board of Directors, Chairman of the Compensation Committee and a member of the Nominating and Governance Committee for Nextgen Healthcare, Inc. since 2009. He is also currently the Chair of the Audit Committee and a member of the Compensation Committee for Sabra Health Care REIT, Inc. He previously served as an independent director on the Boards of Directors of Aratana Therapeutics, Inc., BioPharmX, Inc., and Bazaarvoice, Inc. Mr. Barbarosh also served as the independent board observer for Payless Holdings, LLC and as an independent director for Ruby Tuesday, Inc. He holds his J.D. (with honors) from the University of the Pacific, McGeorge School of Law and earned his B.A. in Business Economics from the University of California at Santa Barbara. | Qualifications: We believe that Mr. Barbarosh is qualified to serve on our Board because of his healthcare industry knowledge and experience as a business leader and public company board member. Skills:

| |||

Independent Director President and Chief Executive Officer, Blue Cross Blue Shield Association Director Since January 2021 Other Public Boards Oak Street Health, Inc. Evolent Board Committees • Audit, Nominating and Corporate Governance | Kim Keck, Age 57 | |||

Kim Keck has served as the President and CEO of Blue Cross Blue Shield Association since January 2021 . From June 2016 to December 2020, Ms. Keck previously served as the President and Chief Executive Officer of Blue Cross Blue Shield of Rhode Island. Previously, Ms. Keck held several leadership roles at Aetna from 2001 to 2016, including Senior Vice President from 2010 to 2016. Ms. Keck serves on the Board of Directors of Oak Street Health and the Blue Cross Blue Shield Association. She received a B.A. in Mathematics from Boston College and an MBA in Finance from the University of Connecticut and is a Chartered Financial Analyst. | Qualifications: We believe that Ms. Keck is qualified to serve on our Board because of her extensive experience in the healthcare industry, particularly within the health insurance payer community. Skills:

| |||

Skills Key |  |  |  |  |  |  |  | |||||||||

| Risk Oversight | Healthcare | Finance | Executive | Technology | ESG | Govt/Regulatory |

| 12 | Evolent Health, Inc. Proxy Statement 2021 |

PROPOSAL 3: ELECTION OF DIRECTORS

Independent Director Main Principal, McClintock Scott Group Director Since November 2015 Other Public Boards Progyny, Inc. Evolent Board Committees • Audit, Compensation, Nominating and Corporate Governance | Cheryl Scott, Age 71 | |||

Cheryl Scott has served as the Main Principal of the McClintock Scott Group since July 2016. From June 2006 to July 2016, Ms. Scott served as Senior Advisor to the Bill & Melinda Gates Foundation. Before joining the foundation, Ms. Scott served for eight years as President and Chief Executive Officer of Group Health Cooperative. She previously served as that organization’s Executive Vice President and Chief Operating Officer. Ms. Scott currently serves on a variety of private and not-for-profit boards. She serves on the Board of Directors of Progyny, Inc., and was a member of the board of directors of Recreational Equipment Incorporated (REI) from 2005 to 2017. Ms. Scott received her bachelor’s degree in communications and master’s degree in health management from the University of Washington. | Qualifications: We believe that Ms. Scott is qualified to serve on our Board because of her extensive career in healthcare, leadership and corporate governance, including as the Chief Executive Officer of Group Health Cooperative. Skills:

| |||

Non-Independent Director Executive Chairman and Former CEO, Evolent Health, Inc. Director Since August 2011 Other Public Boards None Evolent Board Committees None | Frank Williams, Age 54 | |||

Frank Williams, our co-founder, has served as our Executive Chairman since October 2020, and served as our Chief Executive Officer from August 2011 until becoming Executive Chairman. He served as the Chief Executive Officer of The Advisory Board from 2001 to 2008. Mr. Williams was a member of the board of directors of The Advisory Board, a public company, from 2001 to 2015. Prior to joining The Advisory Board, Mr. Williams served as President of MedAmerica OnCall from March 1999 to early 2001, President of Vivra Orthopedics from 1995 to 1999, and as a management consultant for Bain & Co. from June 1988 to June 1990. Mr. Williams holds a bachelor of arts degree in Political Economies of Industrial Societies from the University of California, Berkeley, and a master of business administration from Harvard Business School. | Qualifications: We believe that Mr. Williams is qualified to serve on our Board because of his extensive knowledge and experience in all aspects of our business and his extensive experience in the healthcare and consulting services fields, including as Chief Executive Officer of The Advisory Board. Skills:

| |||

Skills Key |  |  |  |  |  |  |  | |||||||||

| Risk Oversight | Healthcare | Finance | Executive | Technology | ESG | Govt/Regulatory |

Evolent Health, Inc. Proxy Statement 2021 | 13 |

PROPOSAL 3: ELECTION OF DIRECTORS

Other Directors Not Standing for Election at this Annual Meeting

Directors who will continue to serve after the Annual Meeting are:

Class I Directors with Terms Expiring at the 2022 Annual Meeting |

Non-Independent Director Chief Executive Officer. Evolent Health, Inc. Director Since April 2018 Other Public Boards None Evolent Board Committees None | Seth Blackley, Age 42 | |||

Seth Blackley, our co-founder, has served as our Chief Executive Officer since October 2020, and served as our President from August 2011 until his promotion. Prior to co-founding the Company, Mr. Blackley was the Executive Director of Corporate Development and Strategic Planning at The Advisory Board from June 2007 to August 2011. From 2014 to 2016, Mr. Blackley served on the board of directors of Advanced Practice Strategies. Mr. Blackley is currently a board member of Access Clinical Partners and Iodine Healthcare. Mr. Blackley began his career as an analyst in the Washington, D.C. office of McKinsey & Company. Mr. Blackley holds a bachelor of arts degree in business from The University of North Carolina at Chapel Hill, and a master of business administration from Harvard Business School. | Qualifications: We believe that Mr. Blackley is qualified to serve on our Board because of his extensive experience in finance, strategy and operations, especially in the field of healthcare, and his extensive knowledge in all aspects of our business. Skills:

| |||

Non-Independent Director EVP and Chief Strategic and Transformation Officer, UPMC Director Since September 2014 Other Public Boards None Evolent Board Committees None | David Farner, Age 57 | |||

David Farner has been with UPMC for more than 30 years, holding various senior leadership positions for the last 25 years, including interim Chief Financial Officer. Since 2010, Mr. Farner has served as Executive Vice President and Chief Strategic and Transformation Officer of UPMC. Prior to UPMC, Mr. Farner worked as an auditor at Arthur Anderson & Company. Mr. Farner holds a bachelor of science in computer information systems from Westminster College. | Qualifications: We believe that Mr. Farner is qualified to serve on our Board because of his extensive career in healthcare and finance, including various roles at UPMC, a large integrated health delivery systems. Skills:

| |||

Skills Key |  |  |  |  |  |  |  | |||||||||

| Risk Oversight | Healthcare | Finance | Executive | Technology | ESG | Govt/Regulatory |

| 14 | Evolent Health, Inc. Proxy Statement 2021 |

PROPOSAL 3: ELECTION OF DIRECTORS

Independent Director Managing Partner, HLM Venture Partners Director Since January 2020 Other Public Boards None Evolent Board Committees • Compensation, Strategy | Peter Grua, Age 67 | |||

Peter Grua is currently a Managing Partner at HLM Venture Partners (“HLM”), a venture capital investment firm, where his investment activities focus on health services, medical technologies and health care information technologies. Prior to joining HLM, Mr. Grua was a Managing Director at Alex Brown & Sons, an investment banking firm, where he directed research in health care services and managed care. Mr. Grua was previously a director at The Advisory Board Company and Welltower Inc. (formerly Health Care REIT, Inc.), and currently serves as a director at numerous companies including Innovacare Health, Inc., MeQuilibrium, Oceans Healthcare LLC, Ampersand Health, LLC, OnShift, Inc. and Linkwell Health, Inc. Mr. Grua holds a bachelor’s degree from Bowdoin College and a master’s degree in business administration from the Columbia University Graduate School of Business. | Qualifications: We believe Mr. Grua is qualified to serve on our Board because of his extensive industry experience, including as an investment professional. Skills:

| |||

Class II Directors with Terms Expiring at the 2023 Annual Meeting |

Independent Director Chief Medical Officer, Vocera Communications, Inc. Director Since September 2017 Other Public Boards None Evolent Board Committees • Compliance and Regulatory Affairs, Nominating and Corporate Governance | M. Bridget Duffy, MD, Age 62 | |||

M. Bridget Duffy, MD has served as the Chief Medical Officer at Vocera Communications, Inc. since January 2013. Prior to her appointment at Vocera, Dr. Duffy co-founded and served as Chief Executive Officer of ExperiaHealth from November 2010 to December 2012. Dr. Duffy also served as the Chief Experience Officer at the Cleveland Clinic. Dr. Duffy holds a bachelor of science degree from the University of Minnesota and received her doctorate in medicine from the University of Minnesota. She completed her residency in internal medicine at Abbott Northwestern Hospital in Minneapolis, Minnesota. | Qualifications: We believe Dr. Duffy is qualified to serve on our Board because of her extensive experience in healthcare, including as Chief Medical Officer of Vocera. Skills:

| |||

Skills Key |  |  |  |  |  |  |  | |||||||||

| Risk Oversight | Healthcare | Finance | Executive | Technology | ESG | Govt/Regulatory |

Evolent Health, Inc. Proxy Statement 2021 | 15 |

Seth Blackley, our co-founder, has served as our President since August 2011 and on our Board since April 2018. Prior to co-founding the Company, Mr. Blackley was the Executive Director of Corporate Development and Strategic Planning at The Advisory Board from May 2004 to August 2011. From 2014 to 2016, Mr. Blackley served on the board of directors of Advanced Practice Strategies. Mr. Blackley is currently a board member of Access Clinical Partners. Mr. Blackley began his career as an analyst in the Washington, D.C. office of McKinsey & Company. Mr. Blackley holds a bachelor of arts degree in business from The University of North Carolina at Chapel Hill, and a master of business administration from Harvard Business School. We believe that Mr. Blackley is qualified to serve on our Board because of his extensive experience in finance, strategy and operations, especially in the field of healthcare, and his extensive knowledge in all aspects of our business.

Non-Independent Director EVP, UPMC Director Since August 2011 Other Public Boards None Evolent Board Committees • Compliance and Regulatory Affairs, Strategy | Diane Holder, Age 71 | |||

Diane Holder has been an Executive Vice President of UPMC since 2007, President of the UPMC Insurance Services Division and President and CEO of UPMC Health Plan since 2004. Ms. Holder holds a bachelor of arts in psychology from the University of Michigan and a master of science in social work from Columbia University. | Qualifications: We believe that Ms. Holder is qualified to serve on our Board because of her extensive career in healthcare, including as CEO of UPMC Health Plan, part of UPMC, a large integrated health delivery systems. Skills:

| |||

Independent Director Managing Partner, Sears Road Partners LLC Director Since April 2016 Other Public Boards None Evolent Board Committees • Audit, Strategy | Michael D’Amato, Age 67 | |||

| Michael D’Amato has served on our Board since April 2016. Since June 2011, Mr. D’Amato has served as Managing Partner of Sears Road Partners LLC, a private investment company, and since October 2016, Mr. D’Amato has served in various capacities in the finance and strategy functions of Optoro Inc. Prior to joining Sears Road Partners LLC, Mr. D’Amato served as Senior Advisor to Jeff Zients, the Federal Chief Performance Officer and Deputy Director for Management of the Office of Management and Budget from June 2009 to June 2011. From 2004 to 2009, he was a Founding Partner of Portfolio Logic LLC, an investment company focused on small-cap public and private companies, with particular emphasis on healthcare. From 1995 to 2004, he held various executive roles at The Advisory Board, including Chief Financial Officer (1996-1998) and Executive Vice President (1998-2001), and served as a Director from 2001 to 2004. Prior to joining The Advisory Board, Mr. D’Amato held various roles at the management consulting firm Bain & Company, including Senior Partner, where he focused on strategy and organizational development. Mr. D’Amato received a bachelor of science degree from The Massachusetts Institute of Technology and master’s degree in business administration from Harvard Business School. | Qualifications: We believe that Mr. D’Amato is qualified to serve on our Board because of his experience in healthcare, finance and consulting, including his roles as Chief Financial Officer and Director of The Advisory Board. Skills:

| |||

Skills Key |  |  |  |  |  |  |  | |||||||||

| Risk Oversight | Healthcare | Finance | Executive | Technology | ESG | Govt/Regulatory |

| 16 | Evolent Health, Inc. Proxy Statement 2021 |

The Audit Committee of the Board has appointed the accounting firm of PricewaterhouseCoopersDeloitte & Touche LLP (“Deloitte”) to serve as our independent registered public accounting firm to audit the Company’s consolidated financial statements as of and for the fiscal year endingended December 31, 20182020 and its internal control over financial reporting as of December 31, 2020.

As we previously disclosed in a Current Report on Form 8-K filed with the SEC on April 10, 2019, the Audit Committee conducted a competitive process to determine the Company’s independent registered public accounting firm to provide audit services as of and for the 2019 fiscal year. Following review of proposals from the independent registered public accounting firms that participated in the process, the Audit Committee notified PricewaterhouseCoopers LLP (“PwC”) on April 8, 2019, that it was dismissed as the Company’s independent registered public accounting firm, effective immediately. On April 8, 2019, the Audit Committee approved the engagement of Deloitte as the Company’s independent registered public accounting firm to audit the Company’s consolidated financial statements as of and for the year ended December 31, 2019.

The audit reports of PwC on the Company’s consolidated financial statements as of and for the years ended December 31, 2018 and December 31, 2017, did not contain any adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles.

During the fiscal years ended December 31, 2018 and 2017, and the subsequent interim period through April 8, 2019, there were no disagreements within the meaning of Item 304(a)(1)(iv) of Regulation S-K and the related instructions between us and PwC on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to their satisfaction would have caused PwC to make reference in connection with their opinion to the subject matter of the disagreement. Also, during this same period, there were no reportable events within the meaning of Item 304(a)(1)(v) of Regulation S-K, except for a material weakness in internal control over financial reporting related to an insufficient complement of resources with an appropriate level of accounting knowledge, experience and training to address accounting for complex, non-routine transactions. This material weakness was remediated as described in Item 4 to our Quarterly Report on Form 10-Q for the period ended June 30, 2018. PwC has discussed this matter with the Audit Committee, and we have authorized PwC to fully respond to any inquiries of the successor independent registered accounting firm concerning this matter.

During the fiscal years ended December 31, 2018 and December 31, 2017, and the subsequent interim period through April 8, 2019, we have not consulted with Deloitte regarding either (i) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on our financial statements, and no written or oral advice was provided to us by Deloitte that it concluded was an important factor considered by us in reaching a decision as to any accounting, auditing, or financial reporting issue, or (ii) any matter that was subject of a disagreement, as that term is defined in Item 304(a)(1)(iv) of Regulation S-K, or other reportable event of the types described in Item 304(a)(1)(v) of Regulation S-K.

Stockholder ratification of the appointment of PricewaterhouseCoopers LLPDeloitte is not required by law, the New York Stock Exchange (the “NYSE”)NYSE or the Company’s organizational documents. However, as a matter of good corporate governance, the Board has elected to submit the appointment of PricewaterhouseCoopers LLPDeloitte to the stockholders for ratification at the Annual Meeting. Even if the appointment is ratified, the Audit Committee, in its discretion, may select a different independent registered public accounting firm at any time if the Audit Committee believes that such a change would be in the best interest of the Company and its stockholders. If stockholders do not ratify the appointment of PricewaterhouseCoopers LLP,Deloitte, the Audit Committee will take that fact into consideration, together with such other factors it

Evolent Health, Inc. Proxy Statement 2021 | 17 |

Proposal 4: Ratification of Appointment of Independent Registered Public Accounting Firm

deems relevant, in determining its next selection of an independent registered public accounting firm. PricewaterhouseCoopers LLP has served as our independent registered public accounting firm since 2011 andDeloitte is considered by our management to be well-qualified. PricewaterhouseCoopers LLPDeloitte has advised us that neither it nor any member thereof has any financial interest, direct or indirect, in the Company or any of our subsidiaries in any capacity.

A representative of PricewaterhouseCoopers LLPDeloitte will be present at the Annual Meeting, will be given the opportunity to make a statement at the Annual Meeting if he or she so desires and will be available to respond to appropriate questions.

A majority of all of the votes cast at the Annual Meeting at which a quorum is present in person (by virtual attendance) or represented by proxy is required for the ratification of the appointment of PricewaterhouseCoopers LLPDeloitte as our independent registered public accounting firm for the fiscal year ending December 31, 2018.2021. We will treat abstentions as shares that are present and entitled to vote for purposes of determining the presence or absence of a quorum. Abstentions and broker non-votes will have no effect on this proposal.

Fee Disclosure

The following is a summary of the fees billed to us by PricewaterhouseCoopers LLPDeloitte for professional services rendered for us for the fiscal years ended December 31, 20172020 and 2016:

| 2017 | 2016 | ||||||

| Audit Fees | $ | 2,215,000 | $ | 1,654,239 | |||

| Audit-Related Fees | 400,000 | 320,000 | |||||

| Tax Fees | — | — | |||||

| All Other Fees | 2,700 | 1,800 | |||||

| Total | $ | 2,617,700 | $ | 1,976,039 | |||

| 2020 | 2019 | |||||||

Audit Fees | $ | 2,738,600 | $ | 2,316,250 | ||||

Audit-Related Fees | — | 818,933 | ||||||

Tax Fees | 1,030,830 | 933,914 | ||||||

All Other Fees | — | — | ||||||

Total | $ | 3,769,430 | $ | 4,069,097 | ||||

Audit Fees

“Audit Fees” include fees associated with professional services rendered for the audit of the financial statements and services that are normally provided by PricewaterhouseCoopers LLPDeloitte in connection with statutory and regulatory filings or engagements. For example, audit fees include fees for professional services rendered in connection with quarterly and annual reports, the issuance of consents by PricewaterhouseCoopers LLPDeloitte to be named in our registration statements and to the use of their audit report in the registration statements and the issuance of an attestation of management’s report on internal controls over financial reporting, and fees associated with transactions and proposed transactions (including acquisitions and securities offerings).

Audit-Related Fees

“Audit-Related Fees” refers to fees for assurance services in connection with our securities offerings, as well as related services that are reasonably related toassociated with transactions and proposed transactions (including acquisitions and securities offerings) and permissible internal control services for the performance of the audit or review of our financial statements.

Tax Fees

“Tax Fees” refers to fees and related expenses for professional services for tax compliance, tax advice and tax planning.

All Other Fees

“All Other Fees” refers to fees and related expenses for products and services other than services described above, including fees to the independent registered public accounting firm or its affiliates for annual subscriptions to online accounting and tax research software applications and data.

| 18 | Evolent Health, Inc. Proxy Statement 2021 |

Proposal 4: Ratification of Appointment of Independent Registered Public Accounting Firm

Our Audit Committee considersconsidered whether the provision by PricewaterhouseCoopers LLPDeloitte and PwC, as applicable, of any services that would be required to be described under “All Other Fees” would behave been compatible with maintaining PricewaterhouseCoopers LLP’sDeloitte’s and PwC’s respective independence from both management and the Company.

Pre-Approval Policies and Procedures of our Audit Committee

Consistent with SEC policies regarding auditor independence and the Audit Committee’s charter, the Audit Committee is directly responsible for the appointment, compensation, retention, removal and oversight of the independent registered public accounting firm engaged for the purpose of preparing or issuing an audit report or performing other audit, review or attest services for the Company. Our Audit Committee must pre-approve all audit, non-audit and any other services to be provided by the independent registered public accounting firm. All of the fees billed by PricewaterhouseCoopers LLPDeloitte for the professional services rendered for us for the fiscal years ended December 31, 20162019 and 2017,2020, were pre-approved by our Audit Committee.

Notwithstanding anything to the contrary set forth in any of our previous or future filings under the Securities Act of 1933, as amended, (the “Securities Act”) or the Securities Exchange Act of 1934 (the “Exchange Act”), that might incorporate this proxy statement or future filing with the SEC, in whole or in part, the following report shall not be deemed incorporated by reference into any such filing. The Audit Committee operates pursuant to a charter which is reviewed annually by the Audit Committee. Our management is responsible for the preparation, presentation and integrity of our financial statements, the application of accounting and financial reporting principles and our internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. The independent registered public accounting firm is responsible for auditing our financial statements, expressing an opinion as to their conformity with accounting principles generally accepted in the United States and auditing management’s assessment of the effectiveness of internal control over financial reporting. The undersigned members of the Audit Committee of the Board of Directors of Evolent Health, Inc. submit this report in connection with the committee’s review of the financial reports for the fiscal year ended December 31, 20172020 as follows:

| 1. | the Audit Committee has reviewed and discussed with management the audited financial statements and internal control over financial reporting of Evolent Health, Inc. for the fiscal year ended December 31, |

| 2. | the Audit Committee has discussed with representatives of |

| 3. | the Audit Committee has received the written disclosures and the letter from |

Based on the review and discussions referred to above, the Audit Committee recommended to the Board that the audited financial statements of Evolent Health, Inc. be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2017,2020, for filing with the SEC.

Submitted by the Audit Committee

Michael D’Amato (Chairman)

Kim Keck

Cheryl Scott

| 20 | Evolent Health, Inc. Proxy Statement 2021 |

Corporate Governance Highlights The Board continues to evaluate the Company’s corporate governance policies and practices to ensure that the right mix of directors are represented in our boardroom to best serve our stockholders by ensuring effective oversight of our strategy and management. Board Composition Board Performance • In 2020, adopted formal policy to ensure that Evolent considers diverse candidates for Board and CEO succession • Added six independent directors since late 2015 • Further empowered Lead Independent Director role • All NYSE-required Board committees consist solely of independent members • Independent committee chairs • Executive sessionsof independent directors at each meeting • Board and committees may engage outside advisersindependently of management • Oversight of key human capital issues, including diversity and inclusion and executive succession planning • Annual Board, committee and director evaluations • Commitment to continuing director education • Oversight of key risk areas and certain aspects of risk management efforts Policies, Programs and Guidelines Stockholder Rights • In 2020, adopted robust stock ownership guidelines for executives and directors • Compensation clawback policy • Comprehensive Code of Conduct and Business Ethics • Prohibition on hedging and pledging for any officers or directors • Seeking stockholder approval of Board declassification so directors will be elected annually (See Proposal 1) • Seeking stockholder approval of removal of supermajority vote requirements (See Proposal 2) • In 2020, adopted market standard proxy access by-law • Directors elected by majority voting except in contested elections • No stockholder rights plan or “poison pill” We are committed to operating our business under strong and accountable corporate governance practices. Our committee charters, code of business conduct and ethics and corporate governance guidelines are available on our website at www.evolenthealth.com. Any stockholder also may request them in print, without charge, by contacting our Secretary at Evolent Health, Inc., 800 N. Glebe Road, Suite 500, Arlington, VA 22203. Stockholder Engagement Our Board recognizes the importance of regular, two-way dialogue with our investors. Feedback from Evolent’s stockholders is integral to the Board’s decision-making process and accordingly, in 2020, we contacted stockholders representing approximately 57% of Evolent’s outstanding shares to conduct governance-related engagement. We met with stockholders representing approximately 43% of Evolent’s outstanding shares and Cheryl Scott, who became our Lead Independent Director in early 2021, participated in engagements with stockholders representing approximately 37% of outstanding shares. During these discussions, our Board and management team gained valuable input from our investors on matters including Evolent’s corporate governance practices, executive compensation program, and Evolent Health, Inc. Proxy Statement 202121

Corporate Governance and Board Structure

approaches to sustainability, risk oversight and human capital management. Feedback from our investors was shared with our full Board and directly informed implementation of several key governance enhancements over the past year:

| Robust stock ownership guidelines for our executive officers and directors |

| Formal policies to ensure that Evolent considers diverse candidates when conducting Board and CEO succession planning |

| Seeking stockholder approval at this year’s Annual Meeting to remove our remaining supermajority vote requirements for charter and by-law amendments |

| Seeking stockholder approval at this year’s Annual Meeting to declassify the Board, and |

| Market-standard proxy access by-law |

Governance-related outreach is incremental to, and often interlaced with, Evolent’s normal-course Investor Relations program in which stockholders typically comprising a large majority of our shares are engaged during road shows and conferences. We value each of the conversations we have with our investors, and recognize the specific value of our discussions centered on corporate governance, especially as we continue enhancing Evolent’s governance practices. We look forward to facilitating ongoing dialogue with our investors in 2021 and beyond.

Board of Directors Meetings and Committees

The Board met ninefourteen times during 2017.2020. Each incumbent member of the Board attended 75% or more of the meetings of the Board and of the committees on which he or she served that were held during the period for which he or she was a director or committee member, respectively. We do not have a policy on director attendance at our Annual Meeting. None of our directors other than Mr. Williams attended our 20172020 annual meeting of stockholders.

Committees of our Board include the Audit Committee, the Compensation Committee, the Nominating and Governance Committee, and the Compliance and Regulatory Affairs Committee and the Strategy Committee. The principal functions of each of these committees are briefly described below. The Company’s Audit Committee, Compensation Committee and Nominating and Governance Committee are fully independent under the applicable NYSE listing standards and rules of the SEC. The current charters for each of the Audit Committee, Compensation Committee, Nominating and Governance Committee and Compliance and Regulatory Affairs Committee are available on our website at

Director | Audit | Compensation | Nominating and Corporate Governance | Compliance and Regulatory Affairs | Strategy(1) | |||||

Craig Barbarosh | x | x | ||||||||

Seth Blackley | ||||||||||

Michael D’Amato | x* | x | ||||||||

M. Bridget Duffy, MD | x* | x | ||||||||

David Farner | ||||||||||

Peter Grua | x* | x* | ||||||||

Diane Holder | x* | x | ||||||||

Kim Keck | x | x | ||||||||

Cheryl Scott† | x | x | x | |||||||

Frank Williams | ||||||||||

Number of 2020 Meetings | 5 | 5 | 4 | 3 | N/A | |||||

x = Current Committee currently consists of Bruce Felt (Chair), Cheryl ScottMember

* = Chair

† = Lead Independent Director

| (1) | The Strategy Committee was formed in January 2021. |

| 22 | Evolent Health, Inc. Proxy Statement 2021 |

Corporate Governance and Kenneth Samet. In 2017, the Audit Committee met five times. The Audit Committee, among other things:

Audit Committee | ||